Discover Savings in Trading: Unveiling Futures Trading Discount Strategies

Like a trader, the best goal is always to increase profits on assets when reducing loss. Reaching this calls for dealers to have a thorough understanding of the stock markets and seem investment strategies. A great approach that numerous investors ignore is understanding the skill of take profit strategies. In this post, we’ll take a closer look at what take profit is, the many take profit methods, and the way to make use of them to improve your results.

Exactly what is Take Profit?

futures trading review is definitely an instructions which is established by a trader that directs their brokerage to seal a buy and sell when a predetermined selling price levels continues to be arrived at. It really is a trader’s strategy for sealing in revenue. Whenever a trader sets a take profit degree, they are essentially placing the purchase price levels at which they’d want to get out of a business and take their earnings. Take profit is really a chance managing technique that may be useful in unpredictable markets where prices can go up and down speedily.

Different Take Profit Techniques:

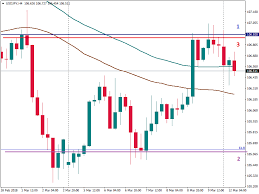

There are actually various methods of utilizing take profit methods, such as honest importance, specialized assessment, and basic evaluation. One method to use specialized assessment would be to established take profit ranges at critical assistance and opposition ranges. This can be done by analyzing the current market selling price craze and determining crucial levels of support and resistance. By way of example, if your trader enters a trade at $100 and recognizes a amount of resistance stage at $110, they could established a take profit degree at $109 in order to avoid the chance of the purchase price falling underneath the level of resistance stage.

Another technique is to use a trailing end-reduction buy like a take profit stage. Trailing end-loss purchases help to lock in income by altering the cease loss level as rates move in the trader’s love. Because of this when the price movements from the trader’s favor, the quit decrease is modified to follow the price to ensure that if the value falls, the industry will likely be sealed in the end-decrease degree.

Using Fundamental Evaluation setting Take Profits:

Fundamental examination is another method that forex traders can use to put take profit amounts. This sort of analysis involves the analysis of any company’s financial and economic standing. Dealers are able to use fundamental assessment to figure out a company’s acceptable worth and set up take profit ranges based on that importance. By way of example, if a trader considers that the clients are undervalued, they may set up a take profit level that may be more than the existing market price.

To put it briefly:

As a trader, learning take profit techniques is crucial in refining profits. Forex traders should carefully evaluate the marketplace pattern, establish support and opposition degrees, and utilize technological and simple evaluation to set take profit ranges. You need to make sure that you have a great knowledge of the current market and the diverse take profit techniques offered just before applying them. By learning these methods, you’ll not just have the ability to increase your earnings and also lessen your failures.

Proudly powered by WordPress. Theme by Infigo Software.